Blockchain technology has been making waves in the financial industry, and for a good reason. It has already disrupted many industries, and the financial sector is no exception. The decentralized and transparent nature allows secure, peer-to-peer transactions without intermediaries, making it a game-changer for the industry.

According to the Australian Blockchain Roadmap, Gartner predicts that “blockchain will generate an annual business value of over US$175 billion by 2025 and over US$3 trillion by 2030. This shows the rapid growth of blockchain implementation in the commercial and financial service sectors.

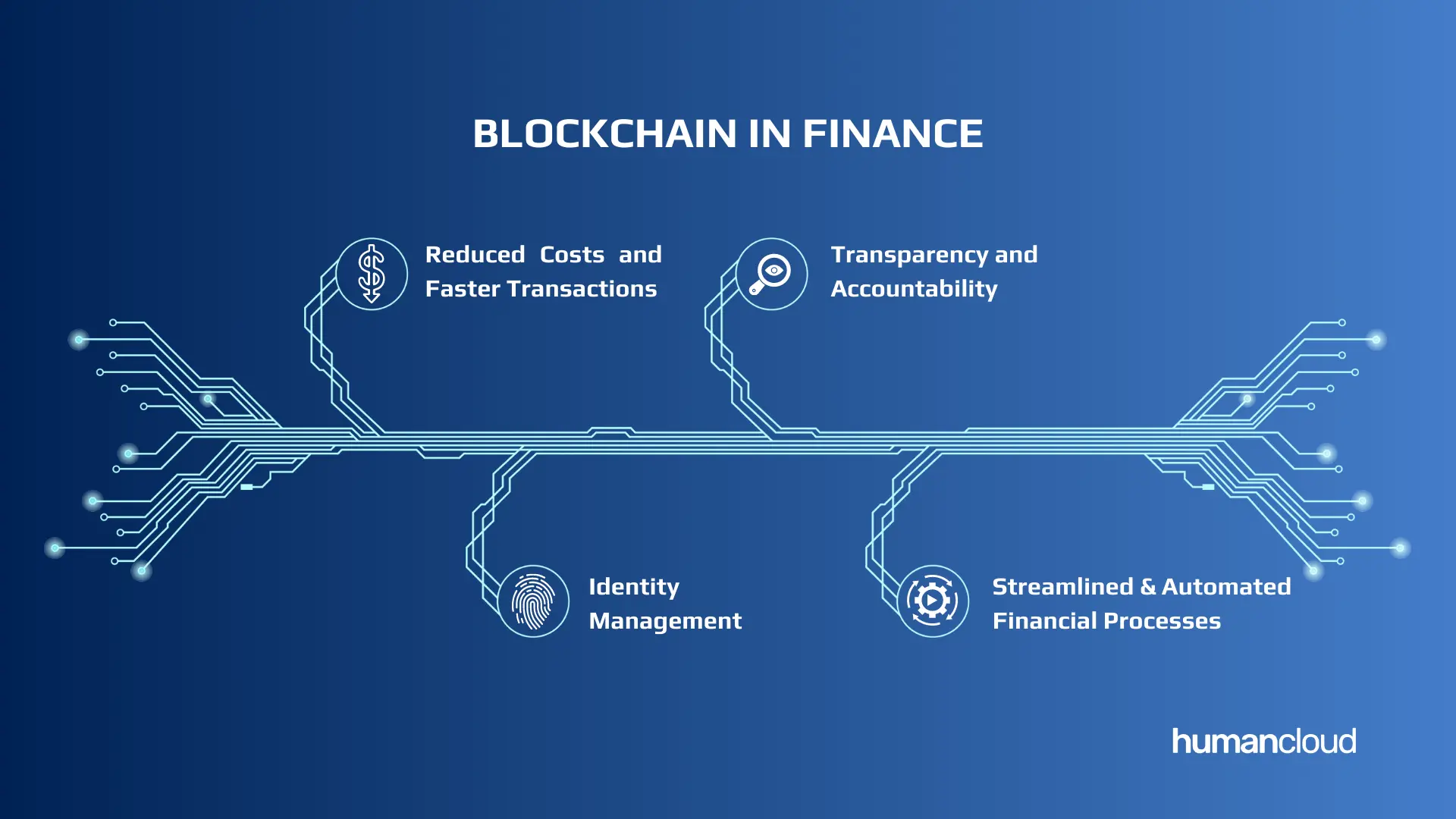

How Blockchain is Disrupting the Financial Industry

Blockchain technology has already begun transforming the financial industry, revolutionizing how financial transactions are processed and managed.

Here's how blockchain is disrupting finance today:

Reduced Costs and Faster Transactions

According to a study done by McKinsey, blockchain in the financial sector is reducing the operational cost of international transactions from USD 26 to 15 and lower annual operational costs for companies by an average of USD 15 billion.

Blockchain-based payment systems are providing a faster, cheaper, and more secure alternative to traditional payment systems. This is due to the elimination of intermediaries, automated processes, and faster settlement times.

Improved Transparency and Accountability

Blockchain's decentralized and transparent nature is increasing transparency and trust in various financial transactions. By providing a secure and tamper-proof ledger, blockchain is allowing all parties involved in a transaction to view and verify the information on the ledger, reducing the risk of fraud and error.

Improved Identity Management

Blockchain-based identity verification systems are providing a more secure and reliable way to verify and authenticate identities. By storing digital identities on a blockchain, individuals can control their identities and prevent fraud and theft. This is particularly valuable in the financial industry, where identity verification is critical for security and compliance.

Streamlined and Automated Financial Processes

From escrow services to supply chain management, Blockchain is streamlining and automating many financial processes. Smart contracts, which are self-executing contracts with the terms of the agreement written into the code, can automate many aspects of financial transactions. This results in faster, more efficient, and more transparent financial processes, reducing the need for intermediaries and increasing trust between parties.

Applications of Blockchain in the Financial Industry

Banks and other financial institutions are increasingly using blockchain to optimize their services, combat fraud and reduce fees for their customers.

There are several blockchain financial service applications that are gaining traction in the industry:

Cross-border Transactions:

Traditionally, transferring money across borders has been a slow and costly process as the system typically passes through multiple banks before reaching its final destination. However, blockchain can significantly expedite cross-border transactions while also increasing accuracy and reducing costs.

Identity Verification:

Blockchain is allowing banks and other financial institutions to verify the identity of individuals using blockchain-enabled IDs. When customer identification information is secured using blockchain, banks can boost public trust while safeguarding against fraud and significantly speeding up the verification process.

Trade Finance:

Trade finance is another area in finance that blockchain is transforming. Many banks are utilizing blockchain trade finance platforms to create smart contracts between participants, which increases efficiency and transparency while opening up new revenue opportunities.

Credit Reporting:

Credit reports significantly impact customers' financial lives, and blockchain-based credit reporting is more secure than traditional server-based reporting, as evidenced by recent data breaches. Blockchain may also enable companies to consider non-traditional factors when calculating credit scores.

Future of Blockchain in the Financial Industry

Blockchain technology has already shown its potential to revolutionize the financial industry, but its impact is still evolving. As the technology continues to mature, there are several areas where it could make an even greater impact:

AI & IoT Integration: The integration of blockchain with other emerging technologies such as Artificial Intelligence and the Internet of Things could lead to even greater efficiency and security in the financial industry. For example, blockchain-based smart contracts could be used in conjunction with AI to automate and streamline financial processes.

Standardization and Interoperability: As more businesses and industries adopt blockchain technology, there is a need for standardization and interoperability between different blockchain platforms. This will allow for greater collaboration and innovation and will make it easier for businesses to adopt blockchain technology.

Regulatory & Legal Developments: As blockchain technology continues to mature, there will be a need for regulatory and legal frameworks to be put in place. This will ensure that the technology is used in a responsible and transparent manner, and will provide businesses with the confidence they need to adopt blockchain technology.

Conclusion

The bottom line is that the financial industry is ripe for disruption, and blockchain technology is at the forefront of this revolution. As more businesses embrace blockchain technology, we can expect to see greater efficiency, transparency, and security in financial transactions. The future of finance is blockchain and businesses that fail to adopt this technology risk being left behind.